Savings AccountĪ savings account is also a demand deposit account, so you can withdraw your money on demand. What’s more, banking regulations impose no limits on the number of transactions you can make from a checking account. It’s about the most liquid asset you can have other than cash, because it provides multiple ways to access your money.įor example, you can write a check, withdraw cash from an ATM, cash a check at a bank branch or pay for purchases with a debit card. Checking AccountĪ checking account is an example of a demand deposit account - a type of bank account that lets you withdraw some or all of your money whenever you want. While some are slightly more liquid than others, the following assets are considered cash equivalents. Other assets are considered liquid because they’re easy to convert to cash. What Are Examples of Liquid Assets?Ĭash, of course, is the most liquid asset of all, and it’s the yardstick used to measure liquidity. Read on to learn more about the difference between liquid assets and nonliquid assets, and how both can help you meet your financial goals. See: 3 Things You Must Do When Your Savings Reach $50,000 Liquid assets can be accessed quickly and easily with little or no cost - like cash, checking accounts and certain investments.

But access to cash doesn’t always mean having currency in your wallet. Investors during this time will pull out of the markets and move their money to other asset classes, making it more challenging for owners of stock to liquidate their assets.Turk_stock_photographer / Getty Images/iStockphotoĪccess to cash can make or break your ability to survive financial emergencies or even secure a mortgage.

It stands to reason that stock liquidity could decrease across the board when the stock market is in decline. Most illiquid stocks, such as small-cap stocks or penny stocks, also have low average share prices, often in the range of $1 to $3. More concerning, there’s the potential for the investors to lose a significant percentage of the stock’s market value. Think well-known, large-cap stocks which trade in high volumes and are consistently in demand from traders and investors.Ĭonversely, stocks that have fewer potential buyers are considered illiquid stocks, or non-liquid stocks.ĭue to low trading volumes, it may take owners of these stocks longer to sell.

Liquid assets examples plus#

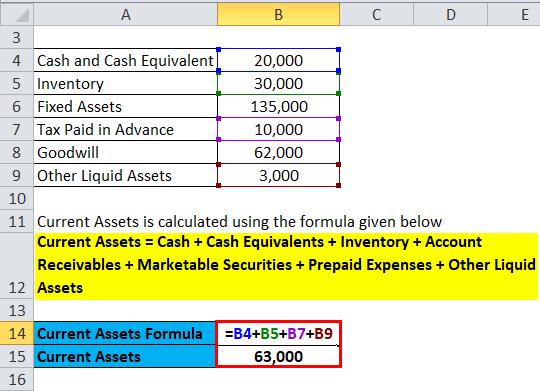

These marketable securities normally have no shortage of buyers, so selling them is relatively easy and quick, plus they tend to retain their value. Let’s start with liquid stocks, which can be loosely defined as stocks that are easily bought and sold at transparent market prices on leading stock exchanges. It really comes down to the difference in trading volumes, and the stock price you’re expecting to enter or exit a position. There is a settlement period of “T=2” to consider with security transactions: meaning the day of the trade plus 2 business days to receive the cash when selling a security such as a stock. These assets are typically in demand by investors, making them easier to sell if you need to. Stocks, corporate and government bonds, and other select investments, fall just below cash in terms of liquidity. Other assets, such as real estate and art, are considered illiquid as they can take longer to sell – and you may lose money on your original investment when you do find a buyer. An investor’s time horizon, risk tolerance, investment objective among other factors will assist in determining how much liquidity should be held within their portfolio.Ĭash is considered the most liquid investment because you can use it almost immediately. Liquidity in general is an important consideration in personal finance. Liquid assets are investments that can be easily sold or converted to cash with minimal impact on their value.

0 kommentar(er)

0 kommentar(er)